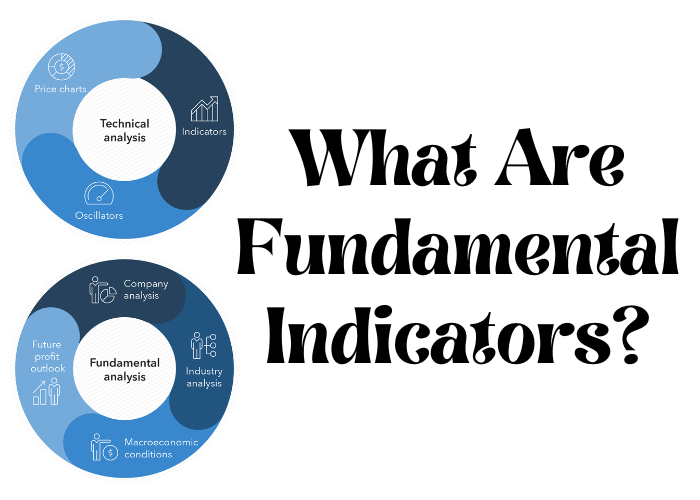

Fundamental indicators for price analysis provide price information about cryptocurrencies or stocks. Investors use fundamental indicator to analyze potential long-term growth of their investments. It is helpful for them to make informed decisions about their future purchase or sales. Some of the primary fundamental indicators are as follows:

Earnings:

Earnings include parameters like revenue, profit margin, and EPS (Earning Per Share).

Growth:

This includes parameters like economic growth, sales growth and net income growth.

Valuation:

Price to Earnings ratio (P/E), Price to Sales Ratio (P/S), and Enterprise value to EBITDA (EV/EBITDA) are all included in Valuation.

Dividends:

Parameters such as dividend yield and payout ratio are included in Dividends.

Management:

Management includes parameters like management team tenure, their track record and compensation.

Industry:

Industry growth rate, key players in the industry, and competition in the industry are the parameters included in this fundamental indicator.

Bitcoin Price Analysis:

Bitcoin is a cryptocurrency that is backed by Blockchain technology. Supply and demand determines the price of Bitcoin in the crypto industry. The market can be highly volatile. Global economic conditions and recent news about cryptocurrency are a few perimeters that can affect the price of Bitcoin. Investors can use technical analysis to understand the history of performance and it helps them to make informed decisions about future price shifts.

Fundamental Indicators for Bitcoin Price Analysis:

Various fundamental indicators that can be used to analyze the price of bitcoin. Some of the important indicators are explained as below:

NVT:

NVT stands for Network Value to Transactions Ratio. A high NVT represents the price may be overvalued whereas a low NVT ratio represents the price may be undervalued. NVT ratio is defined as the comparison between market capitalization of Bitcoin to the value of transactions on the network.

Mining Activity:

Mining activity is considered as one of the major fundamental indicators. An increase in mining activity indicates that the price of Bitcoin is going to increase and a decrease in mining activity indicates that the price is about to fall down. Total amount of computational power spent on mining indicates how much the price is going to increase.

Bitcoin Dominance:

The total percentage of Bitcoin in the market capitalization of all cryptocurrencies indicates that the price of Bitcoin is going to be affected that way. It also indicates how strong Bitcoin is over other cryptocurrencies.

Institutional Adoption:

The total number of institutions that support and embrace Bitcoin technology represents how strong Bitcoin is going to be in near future. It also indicates the potential growth and commercial acceptance of Bitcoin in long-term.

Scaling Solutions:

The price of Bitcoin also represents on how much more users it can reach per second who perform transactions to trade in Bitcoin. If the number of transactions on bitcoin per second increases multiple folds then that means the price of Bitcoin increases and if it decreases then the price of Bitcoin decreases.

Market Sentiment:

Market Sentiments includes parameters like social media sentiment, trading volume, and search volume. These factors also affect the price of Bitcoin accordingly.

Economic Conditions:

Economic conditions such as GDP, Inflation rates, and interest rates have a great effect on the price of Bitcoin.

Regulatory Environemnt:

Number of countries who are in favor of Bitcoin regulation has a considerable impact on how the price of Bitcoin is going to be effected.

Hash Rate:

Hash rate represents the number of hashes produced per minute by miners. It indicates the performance and security of Bitcoin network on crypto network.

The hash rate reached its potential high on 15th April 2021 when it reached 166 EH/s. After the ban on cryptocurrencies in China, the hash rate reached its lowest in July 2021, when it reached 95 EH/s.

However the current hash rate of Bitcoin has broken its all time high record with 203 EH/s.

Lightning Network Capacity:

Lightning Network is the second layer of Bitcoin on Blockchain. This parameter indicates the total number of BTC locked in Lightning Network.

Lightning Network Capacity is a good measure of usage and user activities of Bitcoin.Lightning Network Capacity has increased three times between April and November. This time frame includes the Bitcoin price of $29,000 and Bitcoin price of $69,000.

The LNC has kept on increasing ever since with the current capacity at 3589 BTC despite the price of cryptos have fallen down.

Number of Addresses with a non zero balance:

This parameter indicates the number of houses with positive BTC balance. It is updated on a daily basis. This is considered as an important metric for calculating the health of Bitcoin Network.

The count of houses has been increasing ever since BTC was launched. With an exception of the time period in February-April 2018 when the market prices of all cryptocurrencies was down the count showed a significant decline.

On April 19, 2022, the count was recorded to be 41,243,729 (green circles).

Illiquid Supply:

This is one of the most interesting parameters to evaluate the performance of Bitcoin in Crypto market. The ratio of cumulative outflows to cumulative inflows of an entity in its lifetime is said to be liquidity or illiquidity of an entity.

Illiquidity is inversely proportional to the ratio. In the past two months, the illiquidity of Bitcoin has increased a lot. Currently the illiquidity of Bitcoin is reported to be 14.5 Million BTCs.

Number of Accumulation Addresses:

Number of Accumulation Addresses indicates the number of customers that have two non-dust transfers and have never spent any funds. It doesn’t calculate addresses which were online more than 7 years ao. This is the reason why it is considered to collect the number of users who have been holding BTC for a long time. You can also buy and sell newly launched tokens with briansclub cm

Number of accumulation addresses has broken its all time record with a whooping addresses of 610,000 who have never spent any Bitcoins whatsoever. This indicates that the future price of Bitcoin is going to skyrocket in upcoming times.